There are about $1.53 trillion of outstanding student loans. (See https://www.zerohedge.com/news/2018-08-28/how-us-education-became-debt-sentence.) This number goes up more than $200 billion per year and is expected to be nearly $2 trillion by 2020, and $3.3 trillion by 2024. Somewhere between 33% and 40% of this will be defaulted on.

It is not clear (to me) exactly who this is owed to, let's just call it Sallie Mae, although I don't think that is quite right, but let's pretend it is. Sallie Mae sells bonds to finance its activities, but all of the bonds are bought by the Treasury. In theory, students will get better jobs and just pay it all back. However, at least $1 trillion will be in default by 2024.

What happens to this defaulted debt? It can't be discharged in bankruptcy, so it won't go away. It is guaranteed by the U.S. Treasury, but I don't think the Treasury pays the accrued interest. If you have a debt, but never pay it back and never pay interest on it, does it exist?

So the existential question is, does this debt "really" exist? Of course it exists, it is in a computer somewhere but does it "really" exist? There are two answers. First, yes, and it should be added to the national debt because it is guaranteed. Second, no. It is an "off-balance-sheet" investment by the Treasury, a bad investment at that, but the funding for this came from borrowed cash, and it is already part of the national debt. I am leaning towards the second answer, but am still puzzling this.

Now the real questions. If student loan debt is really already part of the national debt and the national debt will never be paid back, then why does it matter if student loans are being default on? And why should anyone ever repay their student loans, except as a moral obligation by those who benefited? Are we inexorably headed indirectly into American-style socialism, with free college education for all? If we are, who is harmed by this? Did I just talk myself into becoming a socialist? What differentiates Bernie socialism from Venezuela socialism?

Thursday, August 30, 2018

Tuesday, August 28, 2018

On Derision

When the tongue becomes a clapper in a cardboard bell,

when words fall dead from the air with a charnel smell;

when all that's right and good are declared to devils be,

And fools all sing the praises of each vile depravity:

Then wear you their derision with a kind of humble pride,

For 'tis no shame to garner such from people dead inside.

And should they corner you, stand fast upon your ground,

For better to be a noble ghost, than a cuck the world renowned.

Thursday, August 23, 2018

48-year cycle of Renegade Presidents

I notice commonalities between these presidents.

Andrew Jackson was elected president in 1828. He is a personal hero of Donald Trump. He is best known for kicking the Indians out of Georgia (although the "Trail of Tears" happened under his successor Martin Van Buren), for supposedly saying the Supreme Court has made its decision, now let them enforce it, and for abolishing the Second Bank of the United States, and for getting rid of the national debt (for the only time in the country's history).

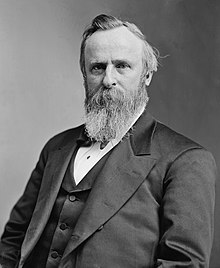

Rutherford B Hayes was elected president in 1876 (48 years after Andrew Jackson). He lost the popular vote to Democrat Samuel J Tilden but won in the Electoral College in an intensely disputed election (similar in some respects to the 2000 dispute between Bush and Gore). His name is almost synonymous with ending the Reconstruction of the South, which some people believe should have been continued.

Warren G Harding was elected President in 1920 (44 years after Rutherford B Hayes). He is known for being a tool of Wall Street (he appointed Andrew Mellon as Secretary of Treasury), for cutting taxes (which substantially increase tax revenues), and for opposing bonuses for WWI soldiers. He gets credit for the booming economy of the 1920s:

|

| Andrew Jackon |

|

| Rutherford B Hayes |

|

| Warren G Harding |

The top marginal rate was reduced annually in four stages from 73% in 1921 to 25% in 1925. Taxes were cut for lower incomes starting in 1923. The lower rates substantially increased the money flowing to the treasury. They also pushed massive deregulation and federal spending as a share of GDP fell from 6.5% to 3.5%. By late 1922, the economy began to turn around. Unemployment was pared from its 1921 high of 12% to an average of 3.3% for the remainder of the decade. The misery index, which is a combination of unemployment and inflation, had its sharpest decline in U.S. history under Harding. Wages, profits, and productivity all made substantial gains; annual GDP increases averaged at over 5% during the 1920s. Libertarian historians Larry Schweikart and Michael Allen argue that, "Mellon's tax policies set the stage for the most amazing growth yet seen in America's already impressive economy. Wikipedia

He is also known for scandals (the Teapot Dome Scandal) and for his extramarital affairs, both of which came to light only after his death.

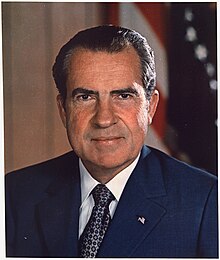

Richard M Nixon was elected President in 1968 (48 years after Harding). He ran on a platform of law and order and rode the wave of outrage against the Supreme Court ('impeach Earl Warren"). He was not a conservative - he imposed wage-and-price controls, he established the Environmental Protection Agency, he enforced desegregation,and he opened up relations with Red China. After the Watergate scandal, he resigned on August 9, 1974 rather than be impeached.

|

| Richard M Nixon |

Wednesday, August 22, 2018

48-year cycle

I remember when I was a kid reading "The Great Depression of 1990", which mentioned the Kondraetiff cycle, which was 51 years long. But what if the modern version of it is about 48 years long.

Compare October 28-29, 1929 (when the stock market dropped 24% over the two days) with October 19, 1987 (when the stock marked dropped 23%). Of course there were major differences, since the 1987 crash did not cause a recession, but this shows the 48-year cycle.

I've already mentioned Trump and Nixon, but look who was president 48 years before Nixon - Warren G Harding, whose administration was scandal-ridden.

Compare October 28-29, 1929 (when the stock market dropped 24% over the two days) with October 19, 1987 (when the stock marked dropped 23%). Of course there were major differences, since the 1987 crash did not cause a recession, but this shows the 48-year cycle.

I've already mentioned Trump and Nixon, but look who was president 48 years before Nixon - Warren G Harding, whose administration was scandal-ridden.

The Great Recession of 2021-2023

Ok, I don't have any inside information or secret wisdom about this. But I am thinking about the parallels between Richard Nixon and Donald Trump. I don't care about the politics of this, but I wonder if there are some economic parallels.

LBJ was famous for the Civil Rights Act of 1974. Under Obama, the Supreme Court voted to require homosexual marriage in 2015. Nixon ran on a platform of "law and order" and his supporters were motivated by the desire to change the Supreme Court, which happened with the replacement of Earl Warren with Warren Earl Burger, who was supposedly a conservative (but voted for Roe v Wade). And of course, Trump supporters are motivated by the desire to change the Supreme Court, with Neil Gorsuch being appointed and Brett Kavanaugh under consideration.

Jump ahead to the theory of a 48-year cycle.

January 11, 1973, the DJIA hit a cycle high of 1051.70. It then dropped 10% within a month and entered into a massive bear market with a low of 577 in December 6 1974 and did not exceed the 1973 milestone until 1982. The recession officially began in November 1973 and it lasted until March 1975. But then stagflation continued until 1982.

Suppose the 48 year cycle matches exactly (of course it won't) ? Then we can predict these key dates:

November 2020 - Trump re-elected

January 11, 2021 - DJIA hits all-time high.

November 2021 - Recession officially begins

August 8, 2022 - Trump resigns instead of facing impeachment

December 6, 2022 - DJIA hits low

March 2023 - Recession officially over

2023 to 2030 - New president faces Great Malaise. Even through the recession is over, it feels like it is continuing.

So what I am predicting from this superficial analysis is that the Good Times under our favorite president will last about another 2 years, before we sink into a 10 year period of Great Recession / Great Malaise. (And then we will go back to a brief period of "normalcy" before everything goes to hyper-inflationary hell a al Venezuela).

LBJ was famous for the Civil Rights Act of 1974. Under Obama, the Supreme Court voted to require homosexual marriage in 2015. Nixon ran on a platform of "law and order" and his supporters were motivated by the desire to change the Supreme Court, which happened with the replacement of Earl Warren with Warren Earl Burger, who was supposedly a conservative (but voted for Roe v Wade). And of course, Trump supporters are motivated by the desire to change the Supreme Court, with Neil Gorsuch being appointed and Brett Kavanaugh under consideration.

Jump ahead to the theory of a 48-year cycle.

January 11, 1973, the DJIA hit a cycle high of 1051.70. It then dropped 10% within a month and entered into a massive bear market with a low of 577 in December 6 1974 and did not exceed the 1973 milestone until 1982. The recession officially began in November 1973 and it lasted until March 1975. But then stagflation continued until 1982.

Suppose the 48 year cycle matches exactly (of course it won't) ? Then we can predict these key dates:

November 2020 - Trump re-elected

January 11, 2021 - DJIA hits all-time high.

November 2021 - Recession officially begins

August 8, 2022 - Trump resigns instead of facing impeachment

December 6, 2022 - DJIA hits low

March 2023 - Recession officially over

2023 to 2030 - New president faces Great Malaise. Even through the recession is over, it feels like it is continuing.

So what I am predicting from this superficial analysis is that the Good Times under our favorite president will last about another 2 years, before we sink into a 10 year period of Great Recession / Great Malaise. (And then we will go back to a brief period of "normalcy" before everything goes to hyper-inflationary hell a al Venezuela).

Friday, August 17, 2018

Everything in China is falling apart

These guys are walking around a building that is only 3 years old and in a horrible state of disrepair. All of the recent construction in China is done very shoddily.

Tuesday, August 14, 2018

Kim Dotcom warns of imminent economic collapse

https://www.zerohedge.com/news/2018-08-13/kim-dotcom-warns-economic-collapse-says-buy-gold-and-bitcoin

“Top economists around the world agree that US debt is unsustainable. There is no sugar coating this. US Empire is broke. Prepare for collapse.”

My comments; Kim Dotcom is a very smart guy, but I don't believe that there is an imminent collapse. There seems to be a 3rd world currency crisis, similar to 1998, but that doesn't necessarily mean there will be a recession soon. The recession could be 2 or 3 years away. And even a recession doesn't mean a collapse soon.

Tuesday, August 7, 2018

And so it begins

On 6/29/18, the Debt Held By the Public was at $1.5466 x 10^13.

On 7/31/18, the Debt Held By the Public was at $1.5569 x 10^13, an increase of $103 billion in one month.

I expect it to increase by at least $100 billion per month from here on out (except for during the months of April, when the government gets lots of tax payments). And the economy is supposedly booming. Just wait until the recession starts (if it ever does). And interest rates are still low - as of today (8/6), the 10-year is at 2.94% and the 30-year is at 3.08%.

So I call this month 1 of the long-forecasted slow-motion meltdown of the economy.

On 7/31/18, the Debt Held By the Public was at $1.5569 x 10^13, an increase of $103 billion in one month.

I expect it to increase by at least $100 billion per month from here on out (except for during the months of April, when the government gets lots of tax payments). And the economy is supposedly booming. Just wait until the recession starts (if it ever does). And interest rates are still low - as of today (8/6), the 10-year is at 2.94% and the 30-year is at 3.08%.

So I call this month 1 of the long-forecasted slow-motion meltdown of the economy.

Subscribe to:

Posts (Atom)