M3 is back! The website nowandfutures.com has reconstructed M3 using public information, with a proprietary tweak. Only the Eurodollars amount is unknown, and it represented only 3% of the total. I don't understand the formula, but most of it is taken from 4 public sources: M2, Institutional Money Market and two weekly reports from the Fed – H.8 and H.4.1.

Here are M3 amounts, using the last date that is in a quarter, starting with 2008.

2007-12-31 13217.70

2008-03-31 14083.09

2008-06-30 14219.85

2008-09-29 15838.96

2008-12-29 16548.56

2009-03-30 16554.70

2009-06-29 16419.11

2009-09-28 16325.43

2009-12-28 15953.31

2010-03-29 15866.70

2010-06-28 15508.50

2010-09-27 15719.64

2010-12-27 15976.30

2011-03-28 16257.76

2011-06-27 17149.10

2011-09-26 16959.77

2011-12-26 16892.36

2012-03-26 17081.06

2012-06-25 17325.76

2012-09-24 17384.79

Source: nowandfutures.com

It might be interesting to come up with a calculation using only the public data.

=========

Update: I think this is too complicated. Institutional money market funds are mostly invested in treasuries, and repos use treasuries as collateral, so if you were to include these you would have to back out the amount of treasuries to avoid double-counting. It's easier just to take my other calculation, M2 + debt held by the public.

Wednesday, October 31, 2012

Money pumping

I'm working on a new economic theory which I call Total Monetary Supply, for lack of a better term. This is based partially on a theory called Monetary Sovereignty, which claims that the debt doesn't matter, since it will never be paid back. So the actual ratio of debt to GDP is also immaterial. The only thing that matters is the possibility that inflation could get out of control.

The number as of 9/30/12 was 19749. But what was it before the crisis of 2008? I want to pick a date at the end of a month, where the total debt held by the public and increase in M2 was less than 50 billion for that month. It looks like a good date is 6/30/2008.

Total Monetary Supply as of 6/30/2008:

M2 (as of 6/30/2008) 7713.2

Public Debt (as of 6/30/2008) 5285.1

Less Debt owned by Fed (as of 6/26/2008) 478.8

-----------------

Total Monetary Supply as of (6/30/2008): 12519.5

So the total monetary supply has increased 7230 in just over 4 years. Just to be clear, that is over $7 trillion dollars.

Compare the GDP numbers:

GDP as of 9/30/2012: 15776 bn

GDP as of 6/30/2008: 14295 bn

Compare the price of gold:

Gold as of 9/30/2012: $1775/oz

Gold as of 6/30/2008: $930/oz

How many ounces of gold could be purchased (assuming enough was available) with the total monetary supply?

On 9/30/2012: 11.1 bn

On 6/30/2008: 13.5 bn

So even though the monetary supply vastly increased, its actual value in gold decreased.

The obvious points are that: 1) Inflation is actually occurring right now as we speak. It is almost 1% per month. 2) It's not showing up in price indexes, because it is not being spent. Very wealthy people are receiving most of this increase and they are just sitting on it. Some of it is going into the stock market. 3) The only way to protect yourself is to buy gold. Duh.

The number as of 9/30/12 was 19749. But what was it before the crisis of 2008? I want to pick a date at the end of a month, where the total debt held by the public and increase in M2 was less than 50 billion for that month. It looks like a good date is 6/30/2008.

Total Monetary Supply as of 6/30/2008:

M2 (as of 6/30/2008) 7713.2

Public Debt (as of 6/30/2008) 5285.1

Less Debt owned by Fed (as of 6/26/2008) 478.8

-----------------

Total Monetary Supply as of (6/30/2008): 12519.5

So the total monetary supply has increased 7230 in just over 4 years. Just to be clear, that is over $7 trillion dollars.

Compare the GDP numbers:

GDP as of 9/30/2012: 15776 bn

GDP as of 6/30/2008: 14295 bn

Compare the price of gold:

Gold as of 9/30/2012: $1775/oz

Gold as of 6/30/2008: $930/oz

How many ounces of gold could be purchased (assuming enough was available) with the total monetary supply?

On 9/30/2012: 11.1 bn

On 6/30/2008: 13.5 bn

So even though the monetary supply vastly increased, its actual value in gold decreased.

The obvious points are that: 1) Inflation is actually occurring right now as we speak. It is almost 1% per month. 2) It's not showing up in price indexes, because it is not being spent. Very wealthy people are receiving most of this increase and they are just sitting on it. Some of it is going into the stock market. 3) The only way to protect yourself is to buy gold. Duh.

Tuesday, October 30, 2012

Rogue UBS trader loses $2.3 billion; 10,000 UBS employees get fired

"Kweku Adoboli, the former UBS AG (UBS) trader on trial over a $2.3 billion trading loss, said his girlfriend encouraged him to confess his losses to managers while another trader on his desk told him to flee the country."

--http://www.businessweek.com/news/2012-10-30/adoboli-s-girlfriend-told-him-to-confess-ubs-trading-loss

"UBS, the Swiss bank, announced plans on Tuesday to eliminate up to 10,000 jobs and cut costs in a major overhaul that will squeeze its earnings in the short term. ... The pullback in the firm’s investment banking operations follows a number of scandals that have engulfed the division. That includes a $2.3 billion trading loss connected to the activities of a former trader, Kweku M. Adoboli, and potential fines related to the manipulation of the London interbank offered rate, or Libor."

--http://dealbook.nytimes.com/2012/10/30/ubs-to-cut-10000-jobs-in-major-overhaul/

--http://www.businessweek.com/news/2012-10-30/adoboli-s-girlfriend-told-him-to-confess-ubs-trading-loss

"UBS, the Swiss bank, announced plans on Tuesday to eliminate up to 10,000 jobs and cut costs in a major overhaul that will squeeze its earnings in the short term. ... The pullback in the firm’s investment banking operations follows a number of scandals that have engulfed the division. That includes a $2.3 billion trading loss connected to the activities of a former trader, Kweku M. Adoboli, and potential fines related to the manipulation of the London interbank offered rate, or Libor."

--http://dealbook.nytimes.com/2012/10/30/ubs-to-cut-10000-jobs-in-major-overhaul/

"It was only when the UBS bankers had their passes refused that they realised

they could be out of a job. Instead of being allowed into the bank’s City

headquarters the traders were whisked to special offices on the fourth floor

where they were handed an envelope containing details of the redundancy process.

“It was like a scene out of the Village of the Damned up there,” said one of

the bankers.

“They said we would be getting two weeks paid leave and then we will be told

what is to happen. I expect we’ll just get a call from human resources or

lawyers telling us how much we are worth. We won’t be able to talk to our

bosses.”

Turned away from their offices, the bankers congregated in The Railway

Tavern, one of the only pubs in the area to open at 8am."

--http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/9643500/UBS-bankers-in-London-head-for-the-pub-after-being-turned-away-at-office-door.html

--http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/9643500/UBS-bankers-in-London-head-for-the-pub-after-being-turned-away-at-office-door.html

Ragnar Danneskjöld steals 700 tons of gold

... ore that is. (Gold ore is the material from which gold is extracted and contains only a small percentage of the precious metal).

A vessel with a nine-person crew and 700 tons of gold ore onboard has disappeared in stormy seas off Russia's Pacific Coast.

A vessel with a nine-person crew and 700 tons of gold ore onboard has disappeared in stormy seas off Russia's Pacific Coast.

Monday, October 29, 2012

Potential disaster of epic proportions

This storm has the potential to be a horrific event - a combination of 9/11, 9/18 (2008), Hurricane Katrina (2007) and Hurricane Wilma (2005). There may be two feet of snow fall after the storm passes. I hope it doesn't come to this but these are some of the things that may happen:

- power outage for a week, shutting down NYC

- Wall Street also being closed for a week with a resulting crash (20%+ drop) of the stock market

- grocery stores being stripped bare, gas stations running out

- people being trapped without food or heat, and hundreds of deaths of elderly people

- alarms shutting down because of the lack of electricity, allowing widespread theft and looting

- airlines, which always have a razor-thin profit margin, in danger of going broke and asking for a bailout

- the election being postponed because voting places can't open

- riots and the National Guard patrolling the streets with machine guns

Saturday, October 27, 2012

Caonima Style

草泥马 Caonima means "grass mud horse". It also means "f*** your mother". Since the party is your mother, it is also an internet meme that means "f*** the party", or more specifically protests internet censorship. So the phrase is very offensive to the party and will cause them to ban any page or site using it.

Since the Gangnam style is about riding horses, with dance moves that imitate galloping and swinging a lasso, the above video, starring political activist Ai WeiWei (艾未未) turns it into a protest against the Communist party (which doesn't like horses, of the grass mud type).

Symbol of defiance of internet censorship.

Friday, October 26, 2012

High national debt will cause a generational depression

These estimates of the economic growth effect of the rapid increase in the debt since President Obama assumed office, plus the Administration’s projection of debt based on its policies continuing, are alarming, absent greater productivity growth and health cost containment than seems warranted by its policies. Of course, President Obama’s successors could continue the do nothing on entitlements policy—at least until forced to do something by a crisis—or reverse course, as could Mr. Obama if he is re-elected and so chooses. If the Obama Administration policies (including the absence of Social Security and Medicare reform) were eventually reversed, and the debt-GDP ratio stabilized at a lower level than those in Table 1 or, better yet, gradually decreased, the harmful effects would be correspondingly attenuated, as the “debt stabilized at 2016 level” case developed above indicated. While substantial long-run damage would already have occurred, the economic “gain” from the political “pain” of seriously reforming entitlement cost growth is enormous. Failing to rapidly begin bending the long-run debt-GDP curve down risks a growth disaster, whose severity could be much worse even than the recent deep recession and tragically anemic recovery. Left unchecked, it eventually risks a lost generation of growth, a long-run growth depression.

Source: http://siepr.stanford.edu/?q=/system/files/shared/pubs/papers/briefs/pb_11_2012.pdf

GDP at $15,776 billion

"Current-dollar GDP -- the market value of the nation's output of goods and services -- increased

5.0 percent, or $190.1 billion, in the third quarter to a level of $15,775.7 billion."

(Source: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm)

Previous numbers:

9/30/2011 15176

12/31/2011 15294

3/31/3011 15321

6/30/2012 15596

So, nominal GDP is up YOY at 3.95%.

(Source: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm)

Previous numbers:

9/30/2011 15176

12/31/2011 15294

3/31/3011 15321

6/30/2012 15596

So, nominal GDP is up YOY at 3.95%.

Too big to fail

This isn't news, but these are the list of TBTF banks in the US.

Bank of America (BAC), Citigroup (C), JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), Morgan Stanley (MS), Bank of New York Mellon (BK) and State Street (STT).

(source: http://www.thestreet.com/story/11300685/1/8-us-banks-make-too-big-to-fail-list.html).

Since these are TBTF, any bonds or securities that they issue should be considered backed by the Federal Reserve and/or Treasury, the same as Fannie Mae (FNMA), Freddie Mac (FMCC), and Ginnie Mae (GNMA). They should possibly be included in the total national debt.

Bank of America (BAC), Citigroup (C), JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), Morgan Stanley (MS), Bank of New York Mellon (BK) and State Street (STT).

(source: http://www.thestreet.com/story/11300685/1/8-us-banks-make-too-big-to-fail-list.html).

Since these are TBTF, any bonds or securities that they issue should be considered backed by the Federal Reserve and/or Treasury, the same as Fannie Mae (FNMA), Freddie Mac (FMCC), and Ginnie Mae (GNMA). They should possibly be included in the total national debt.

Thursday, October 25, 2012

Keynesian arrogance

To defend their radical attack, pseudoconservatives suggest that shrinking the government will help the economy. This is a canard. It ignores that by definition, GDP = C + I + G + E, where C is consumption, I is investment, G is government consumption expenditures and gross investment, and E is net exports. Any reduction in G is an immediate reduction in GDP. Because the reduction will diminish demand for goods and services, the eventual multiplied effect may exceed the amount of the reduction. Any dismissed government employees are consumers sent into unemployment. As for secondary effects, declaring that a smaller government is better for the economy does not make it so. It seem unlikely that businesses will order new equipment, or that consumers will buy more groceries, if they hear that the enormous government is smaller than it once was.This is what I mean by Keynesian arrogance. Any government spending by this definition is good, and the more government spending is better, up the the limit of full employment. But this ignores the fact that most government spending is either wasteful or even harmful. If you hire one man to dig a hole and another man to fill it back in then you have created two jobs. If you shut down this jobs program, then the above author would complain that you are hurting the economy.

--http://www.huffingtonpost.com/louis-m-guenin/why-voters-should-turn-fr_b_2005275.html

The G in the above equation refers to government deficit spending. But deficit spending can occur only by stealing the same amount of value from holders of US dollars. I've shown in a previous post, that each trillion dollars of deficit spending will cause inflation of about 5% (it adds to the total money supply of about $19 trillion).

So the Keynesians advocate stealing (which is what deficit spending is) from those who have money, and giving it to people who waste it.

A true economic recovery should not depend on deficit spending at all. Adjustment to this honest economy will cause some short-term pain to the looters, but will result in long-term prosperity, whereas an ever-expanding government will eventually cause the whole system to collapse.

Monday, October 22, 2012

Fastest growing cities on earth

- Puning, China

- Foshan, China

- Jinjiang, China

- Yamoussoukro, Ivory Coast

- Shenzhen, China

- Dongguan, Guangdong, China

- Abuja, Nigeria

- Huizhou, China

- Quanzhou, China

- Ouagadougou, Burkina Faso

- Zhongshan, China

- Fuyang, China

- Kigali, Rwanda

- Linyi, Shandong, China

- Taizhou, Jiangsu, China

- Zhuhai, China

- Lilongwe, Malawi

- Jieyang, China

- Sana'a, Yemen

- Shaoxing, China

- Haikou, China

- Maoming, China

- Jiangmen, China

- Shantou, China

- Huambo, Angola

- Yiyang, Hunan, China

- Kabul, Afghanistan

- Luanda, Angola

- Nanyang, Henan, China

- Niamey, Niger

- Xiamen, China

And in contrast, these are the fastest shrinking:

- Dnipropetrovsk, Ukraine

- Budapest, Hungary

- Donetsk, Ukraine

- Zaporizhzhya, Ukraine

- Nizhniy Novgorod, Russia

- Saratov, Russia

- Monrovia, Liberia

- Busan, South Korea

- Perm, Russia

- Kharkiv, Ukraine

- St. Petersburg, Russia

- Samara, Russia

- Odessa, Ukraine

- Seoul, South Korea

- Tbilisi,Georgia

- Ufa, Russia

- Turin, Italy

- Voronezh, Russia

- Bucharest, Romania

- Volgograd, Russia

- Prague, Czech Republic

- Chelyabinsk, Russia

- Omsk, Russia

- Yerevan, Armenia

- Milan, Italy

- Novosibirsk, Russia

- Rome, Italy

- Havana, Cuba

What about Detroit?

Sunday, October 21, 2012

The Hong Kong dollar is the new safe haven

Reuters: - The Hong Kong Monetary Authority (HKMA) stepped in to the currency market on Saturday for the first time since December 2009 as capital inflows strengthened the Hong Kong dollar, causing it to hit the top end of its trading range.

"The recent increase in demand for the local currency is related to a less strained European market, weakness in the USD and declining US interest rates, which have prompted capital inflows into currency and equity markets in the region," an HKMA spokesman said in a statement.

The Hong Kong dollar (HKD) is a pegged currency (to USD) with fairly low downside risk. If anything the HKD is more likely to be adjusted up. Hong Kong's equities sold off sharply in the spring but have been rallying since early summer as global asset managers are increasing allocations to the city-state. Some view Hong Kong as a safer play on China's market recovery. Whatever the case, it seems that traders have found a new "safe-haven" currency - for now. --http://soberlook.com/2012/10/what-is-displacing-yen-as-safe-haven.html

My uncle is a dictator

Kim Han Sol

http://www.koreabang.com/2012/videos/kim-jong-uns-nephew-in-rare-tv-interview-netizens-grow-fond.html

This is an interview with Kim Han Sol, Kim Jong Un's nephew. He is 17 and speaks English very well. He lives in Macau with his father, but will be going to college in Mostar, Bosnia-Herzegovina.

It's Mormon in America

"Mormons enjoy levels of education and wealth higher than the national average, for example. Some 54 percent of LDS men and 44 percent of women have secured postsecondary education; the numbers for the general American population are 37 percent and 28 percent, respectively.

The best advertisement for Mormonism, though, is the kind of society that it seems able to create. Utah, 60 percent of whose population belongs to the LDS Church, has enjoyed one of the fastest job-growth rates in the nation over the past decade, taking a strong lead in a host of industries, from energy and software to composite manufacturing. It has also seen the highest population growth rate of any state, aside from neighboring Arizona and Nevada—and unlike those “bubble” states, Utah survived the housing bust in strong shape. The Beehive State’s success is less about low taxes—Utah is not a tax haven like Texas, Nevada, or Florida—than about support for wealth-creating industry. Utahans have a great interest in promoting business growth. Such cost advantages, plus the presence of an educated population, appeal to global companies. Goldman Sachs, for example, has set up its second-largest American operation in downtown Salt Lake City. “We consider Salt Lake a high-leverage location,” says Goldman managing director David Lang. “There’s a huge cost differential, and you have a huge, talent-rich environment.” Drive through Provo, and you’ll see office buildings, often just finished, for some of Silicon Valley’s signature companies, including Intel, Adobe, Twitter, eBay, and Fairchild Semiconductor. Over the past decade, the number of Salt Lake–area employees in STEM jobs (those relating to science, technology, engineering, or math) has increased 17.5 percent. The number of such jobs actually declined in Silicon Valley and stagnated in New York, Boston, and Los Angeles."

--http://www.newgeography.com/content/003164-it-s-mormon-america

The best advertisement for Mormonism, though, is the kind of society that it seems able to create. Utah, 60 percent of whose population belongs to the LDS Church, has enjoyed one of the fastest job-growth rates in the nation over the past decade, taking a strong lead in a host of industries, from energy and software to composite manufacturing. It has also seen the highest population growth rate of any state, aside from neighboring Arizona and Nevada—and unlike those “bubble” states, Utah survived the housing bust in strong shape. The Beehive State’s success is less about low taxes—Utah is not a tax haven like Texas, Nevada, or Florida—than about support for wealth-creating industry. Utahans have a great interest in promoting business growth. Such cost advantages, plus the presence of an educated population, appeal to global companies. Goldman Sachs, for example, has set up its second-largest American operation in downtown Salt Lake City. “We consider Salt Lake a high-leverage location,” says Goldman managing director David Lang. “There’s a huge cost differential, and you have a huge, talent-rich environment.” Drive through Provo, and you’ll see office buildings, often just finished, for some of Silicon Valley’s signature companies, including Intel, Adobe, Twitter, eBay, and Fairchild Semiconductor. Over the past decade, the number of Salt Lake–area employees in STEM jobs (those relating to science, technology, engineering, or math) has increased 17.5 percent. The number of such jobs actually declined in Silicon Valley and stagnated in New York, Boston, and Los Angeles."

--http://www.newgeography.com/content/003164-it-s-mormon-america

Thursday, October 18, 2012

Wednesday, October 17, 2012

Who is the Prophet Mormon?

This is according to the beliefs of the LDS.

The Nephite prophet Mormon

The prophet Mormon was born about AD 311 in what is today upstate New York. He was a member of the Nephite tribe. When he was 10, he was visited by the Prophet Ammaron, who told him about the location of the sacred Nephite records and told him to wait until he was 24 to retrieve them. Mormon had access to 1000 years of Nephite records and he redacted (edited) them into the Book of Mormon, which includes some of his own words. Mormon wrote on gold plates and wrote in a language called "reformed Egyptian". He buried them in a hill named Cumorah (near present-day Manchester, New York). He entrusted them to his son, the prophet Moroni. In about AD 385, the prophet Mormon then led the Nephites in a great battle against the Lamanites, and the Nephites were totally wiped out, except for Moroni, the last surviving Nephite.

Moroni (not to be confused with Captain Moroni) completed the work of his father, and added his own book, the Book of Moroni, which he added to the records at Hill Cumorah. After Moroni's death, he was resurrected and became an angel.

The angel Moroni first appeared to Joseph Smith Jr, on September 21, 1823. Joseph found the gold plates the next day, but the angel prevented him from taking them. He finally was able to retrieve them in September 1827. Over the next several years, he was able to translate them with the assistance of a seer stone. In about 1830, he was finished with the translation and returned them to the cave in the Hill. And then the angel Moroni took them back.

The Nephite prophet Mormon

The prophet Mormon was born about AD 311 in what is today upstate New York. He was a member of the Nephite tribe. When he was 10, he was visited by the Prophet Ammaron, who told him about the location of the sacred Nephite records and told him to wait until he was 24 to retrieve them. Mormon had access to 1000 years of Nephite records and he redacted (edited) them into the Book of Mormon, which includes some of his own words. Mormon wrote on gold plates and wrote in a language called "reformed Egyptian". He buried them in a hill named Cumorah (near present-day Manchester, New York). He entrusted them to his son, the prophet Moroni. In about AD 385, the prophet Mormon then led the Nephites in a great battle against the Lamanites, and the Nephites were totally wiped out, except for Moroni, the last surviving Nephite.

Moroni (not to be confused with Captain Moroni) completed the work of his father, and added his own book, the Book of Moroni, which he added to the records at Hill Cumorah. After Moroni's death, he was resurrected and became an angel.

The angel Moroni first appeared to Joseph Smith Jr, on September 21, 1823. Joseph found the gold plates the next day, but the angel prevented him from taking them. He finally was able to retrieve them in September 1827. Over the next several years, he was able to translate them with the assistance of a seer stone. In about 1830, he was finished with the translation and returned them to the cave in the Hill. And then the angel Moroni took them back.

Mitt Romney's Polygamous Ancestors

Of Mitt Romney's 4 great-grand-fathers, 2 were polygamous: Miles Park Romney (who had 5 wives and 31 children and moved to Mexico in 1885) and Helaman Pratt (who had 3 wives and 20 children and moved to Mexico in 1876).

Of Mitt Romney's 8 great-great-grand fathers, 4 were polygamous: Archibald Newell Hill (who had 5 wives and 14 children); Parley Parker Pratt, Sr. (who had 12 wives and 30 children and was murdered by the jealous husband of his 12th wife); Carl Heinrich "Charles Henry" Wilcken (who had 4 wives and 21 children and deserted from the US Army in 1857); and Lewis Robinson (who had 4 wives and 23 children).

In addition, his great-great-grandmother Elnora Warner Berry Dalton, (mother of Mitt's great-grandmother Rosetta Berry, whose father was Robert Berry), took as her 2nd husband Simon Dalton (who had 5 wives and an unknown number of children). She had two surviving children from her first marriage, and six from her second. In fairness to her, she believed that her first husband had abandoned her, but she never divorced him.

Also, great-great-grandfather Miles Romney (father of Miles Park Romney) was sealed to 11 women by proxy in 1872, but these could not be considered marriages.

See: A Brief Guide to Mitt Romney's Polygamous Heritage.

Mitt Romney's Ancestry

Of Mitt Romney's 8 great-great-grand fathers, 4 were polygamous: Archibald Newell Hill (who had 5 wives and 14 children); Parley Parker Pratt, Sr. (who had 12 wives and 30 children and was murdered by the jealous husband of his 12th wife); Carl Heinrich "Charles Henry" Wilcken (who had 4 wives and 21 children and deserted from the US Army in 1857); and Lewis Robinson (who had 4 wives and 23 children).

In addition, his great-great-grandmother Elnora Warner Berry Dalton, (mother of Mitt's great-grandmother Rosetta Berry, whose father was Robert Berry), took as her 2nd husband Simon Dalton (who had 5 wives and an unknown number of children). She had two surviving children from her first marriage, and six from her second. In fairness to her, she believed that her first husband had abandoned her, but she never divorced him.

Also, great-great-grandfather Miles Romney (father of Miles Park Romney) was sealed to 11 women by proxy in 1872, but these could not be considered marriages.

See: A Brief Guide to Mitt Romney's Polygamous Heritage.

Mitt Romney's Ancestry

Tuesday, October 16, 2012

Chongqing is the Chicago of China

Chicago is the 6th most economically powerful city on earth, by my calculation, and it has 8.7 million in its metropolitan area. " The city is an international hub for finance, commerce, industry, telecommunications, and transportation, with O'Hare International Airport being the second-busiest airport in the world in terms of traffic movements." It has 1,209 high-rises (buildings between 35m and 100m), and 416 skyscapers (buildings taller than 100m) , including 108 that are taller than 150m.

Chongqing (重庆市)

has about 7 million in its urbanized area, and almost 29 million people in its greater metropolitan area. It has 49 buildings taller than 150m, with another 21 under construction. " “Chongqing is “an industrial gateway that opens the country to its vast, rural heartland”; its “warp-speed industrialization and drive toward modernization” makes it not so much like today’s Chicago as that of the 19th century—broad shoulders, The Jungle, and all that."

See also: Chicago on the Yangtze

America's 50 Best Cities

See: http://images.businessweek.com/slideshows/2012-09-26/americas-50-best-cities

The top 3 are:

#3 Washington DC

#2 Seattle

#1 San Francisco

The top 3 are:

#3 Washington DC

#2 Seattle

#1 San Francisco

China's problem with high-speed rail

The Wenzhou crash [on 7/23/11] killed forty people and injured a hundred and

ninety-two. For reasons both practical and symbolic, the government was

desperate to get trains running again, and within twenty-four hours it

declared the line back in business. The Department of Propaganda ordered

editors to give the crash as little attention as possible. “Do not

question, do not elaborate,” it warned, on an internal notice. When

newspapers came out the next morning, China’s first high-speed train

wreck was not on the front page.

The Mormon Nation

A nation is a community of people who share a common language, culture, ethnicity, descent, or history. For example, the Navajo Nation or Cherokee Nation. A state refers to the government. A nation-state is the government for a nation, for example Albania or Estonia. Most states are multi-ethnic.

I argue that the Mormons are an emerging nation. They have a President, Thomas Monson. The President ("Pope") is selected by the Quorum of the Twelve Apostles ("College of Cardinals"), making this a theocracy, like the Roman Catholic Church. As an emerging nation, if it contains to increase in power and size, it will want its own sovereign territory at some point.

The Church owns several for-profit companies (which pay tax), such as Property Reserve, Inc. which develops commercial real estate such as the City Creek Center, an upscale mall in downtown Salt Lake City costing $2 billion. Deseret Management Corporation (DMC) has over 2,000 employees. Through Hawaii Reserves (a subsidiary of DMC), it owns the Laie Shopping Center and other properties on Oahu island, Hawaii. Through AgReserves, it owns over 1 million acres of farmland in the US. A recent study claims that the church owns over $40 billion of assets, including $6 billion of stocks and bonds, and has $8 billion of tithe revenue per year.

"The LDS Church’s legions of missionaries and volunteers don’t merely spread the Mormon message around the world; they’re also vital to the church’s businesses." Some of the "missionaries" are like unpaid interns, doing work like data entry. They learn foreign languages, which are later useful in business.

The Church has 139 temples throughout the world (with another 15 under construction) which act as embassies.

There are 5 Mormon Senators (Harry Reid, D-NV; Orrin Hatch, R-UT; Mike Crapo, R-ID; Mike Lee, R-UT; and Tom Udall, D-NM). There are also 9 Mormon Representatives, and 1 governor, Gary Herbert of Utah.

Ok, so what is the big deal? JFK was a Catholic, Romney is a Mormon. He isn't going to try to force everyone to becoming Mormon. The difference is that JFK was only a member of the church, not part of the church hierarchy. His only involvement was really going to Mass once in a while. Whereas Romney is a very prominent church leader. A vote for Romney is a vote to increase the influence and power of the Mormon church. Is that better than the alternative?

I argue that the Mormons are an emerging nation. They have a President, Thomas Monson. The President ("Pope") is selected by the Quorum of the Twelve Apostles ("College of Cardinals"), making this a theocracy, like the Roman Catholic Church. As an emerging nation, if it contains to increase in power and size, it will want its own sovereign territory at some point.

The Church owns several for-profit companies (which pay tax), such as Property Reserve, Inc. which develops commercial real estate such as the City Creek Center, an upscale mall in downtown Salt Lake City costing $2 billion. Deseret Management Corporation (DMC) has over 2,000 employees. Through Hawaii Reserves (a subsidiary of DMC), it owns the Laie Shopping Center and other properties on Oahu island, Hawaii. Through AgReserves, it owns over 1 million acres of farmland in the US. A recent study claims that the church owns over $40 billion of assets, including $6 billion of stocks and bonds, and has $8 billion of tithe revenue per year.

"The LDS Church’s legions of missionaries and volunteers don’t merely spread the Mormon message around the world; they’re also vital to the church’s businesses." Some of the "missionaries" are like unpaid interns, doing work like data entry. They learn foreign languages, which are later useful in business.

The Church has 139 temples throughout the world (with another 15 under construction) which act as embassies.

There are 5 Mormon Senators (Harry Reid, D-NV; Orrin Hatch, R-UT; Mike Crapo, R-ID; Mike Lee, R-UT; and Tom Udall, D-NM). There are also 9 Mormon Representatives, and 1 governor, Gary Herbert of Utah.

Ok, so what is the big deal? JFK was a Catholic, Romney is a Mormon. He isn't going to try to force everyone to becoming Mormon. The difference is that JFK was only a member of the church, not part of the church hierarchy. His only involvement was really going to Mass once in a while. Whereas Romney is a very prominent church leader. A vote for Romney is a vote to increase the influence and power of the Mormon church. Is that better than the alternative?

Monday, October 15, 2012

Nanjing is the Atlanta of China

Atlanta is the cultural capital of the Southern United States and has 5.3 million in its metro area. It was burned to the ground during the civil war, but it has become a national center of commerce. " The city’s skyline, which began its marked rise in the 1960s, is punctuated with buildings of both modern and postmodern vintage. At 1,023 feet (312 m), Atlanta’s tallest skyscraper—the Bank of America Plaza—is the 52nd-tallest building in the world and the 9th tallest building in the United States."

Nanjing

Nanjing (南京) means "Southern Capital". "During the period of the North-South Division, Nanjing remained the capital of the Southern Dynasties for more than two and a half centuries. The city of Nanjing was razed after the Sui took over it. It was reconstructed during the late Tang Dynasty. ... With an urban population of over seven million (2011), Nanjing is the second-largest commercial centre in the East China region after Shanghai." "Today, with a long cultural tradition and strong support from local educational institutions, Nanjing is commonly viewed as a “city of culture” and one of the more pleasant cities to live in China." The tallest skyscraper in Nanjing is Zifeng tower, at 450m, was completed in 2009, and it is the 8th tallest building in the world.

See also: Evolving Urban Form: Nanjing

Qingdao is the Miami of China

Skyscrapers in Miami

Miami is a major city in Florida, with a metro area of 5.5 million. "For more than two decades, the Port of Miami, known as the 'Cruise Capital of the World,' has been the number one cruise passenger port in the world, accommodating some of the world's largest cruise ships and operations, and is currently the busiest in both passenger traffic and cruise lines." Neighboring Ft. Lauderdale also has a major port, from which it is possible to take a ferry to Bahamas. The Florida Institute of Technology in nearby Melbourne has one of the best maritime colleges in the US. Miami is known for its many beaches.

Skyscrapers in Qingdao

Qingdao (青岛) in Shandong (山东) Province has a population of 3.7 million in its urban area. "The world's longest sea bridge, the Qingdao Haiwan Bridge, links the main urban area of Qingdao with Huangdao district, straddling the Jiaozhou Bay sea areas. In 2009 and 2011, Qingdao was named China's most livable city. ...The Orient Ferry connects Qingdao with Shimonoseki, Japan. There are two ferry lines connecting Qingdao with South Korea. The New Golden Bridge II operates between Qingdao and Incheon, and the Blue Sea Ferry operates between Qingdao and Gunsan. Qingdao hosts one of China's largest seaports." Along with Beijing's hosting of the 2008 Summer Olympics, Qingdao was the host city for the Olympic Sailing competitions which took place along the shoreline by the city. These events were hosted at the Qingdao International Sailing Centre. Qingdao was a German concession until 1922, and it retains some traditional foreign architecture. "Qingdao is one of the few cities in northern China where surfing is possible." The Ocean University of China is located there.

Former site of the headquarters of the German Administration

Shi

市 shi simply means "city" or "market", and so it is part of many names of cities. It helps the "shi" sounds sort of like "city"

市 (shi) is an alternate form of the same character

中 zhong means China or center

中山市 Zhongshan-Shi means Zhongshan (Middle Mountain) City, which is in Guangdong province

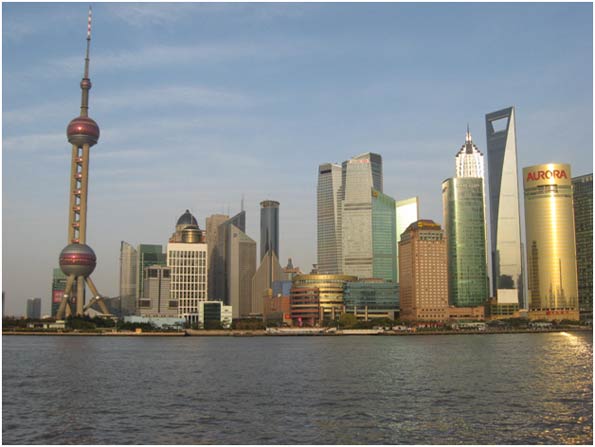

上海市 Shanghai Shi is the city of Shanghai

广州市 Guangzhou Shi is the city of Guangzhou

天津市 Tianjin Shi is the city of Tianjin (near Beijing)

台北市 Taipei Shi is Taipei City.

杰佛逊市 Jie-Fo-Xun Shi is Jefferson City (Missouri)

区 qu is "area, region, or district"

镇 zhen means "small town"

市鎮 (shi zhen) is translated as just "town"

心 xin means "heart, mind"

中心 zhong-xin is "center"

市鎮中心 (shi-zhen zhong-xin) is "town center"

政 zheng means "government" or "politics"

市政中心 (shi-zheng zhong-xin) means "civic center".

市政中心 (旧金山) (shi-zheng zhong-xin Jiu-Jin-Shan) is the San Francisco Civic Hall

市 (shi) is an alternate form of the same character

中 zhong means China or center

中山市 Zhongshan-Shi means Zhongshan (Middle Mountain) City, which is in Guangdong province

上海市 Shanghai Shi is the city of Shanghai

广州市 Guangzhou Shi is the city of Guangzhou

天津市 Tianjin Shi is the city of Tianjin (near Beijing)

台北市 Taipei Shi is Taipei City.

杰佛逊市 Jie-Fo-Xun Shi is Jefferson City (Missouri)

区 qu is "area, region, or district"

镇 zhen means "small town"

市鎮 (shi zhen) is translated as just "town"

心 xin means "heart, mind"

中心 zhong-xin is "center"

市鎮中心 (shi-zhen zhong-xin) is "town center"

政 zheng means "government" or "politics"

市政中心 (shi-zheng zhong-xin) means "civic center".

市政中心 (旧金山) (shi-zheng zhong-xin Jiu-Jin-Shan) is the San Francisco Civic Hall

Sunday, October 14, 2012

Who is Zhang Weiying?

Zhang Weiying, 张维迎

"Mr. Zhang’s academic colleagues were all praise for the “China Model,” but in 2009 he was giving speeches entitled “Bury Keynesianism.” Then a top administrator at Peking University, where he now teaches economics, he argued that since the financial crisis was caused by easy money, it couldn’t be solved by the same. “The current economy is like a drug addict, and the prescription from the doctor is morphine, so the final result will be much worse,” he said.

He invoked the ideas of the late Nobel laureate Friedrich Hayek and the Austrian School of Economics to argue that if the economy weren’t allowed to adjust on its own, China’s minor bust would be followed by a bigger one. He also advocated doing away with existing distortions such as the monopolies enjoyed in many industries by state-owned enterprises."

--http://dailycapitalist.com/2012/10/14/an-austrian-in-china/

See also: http://www.nytimes.com/2012/06/17/world/asia/in-shift-china-stifles-debate-on-economic-change.html

"A cause célèbre in Chinese economics circles, Mr. Zhang was fired a year

and a half ago from his post as dean of the university’s Guanghua School of Management.

Since then, he has been on an extended sabbatical, traveling widely and

giving speeches on the country’s brewing economic troubles, among them

slowing domestic growth and a collapse of financing for private

enterprise.

The hitch is that much of his work is deliberately hard to access or is consigned to secondary publications."

Zhongshan Square

Zhongshan (中山) Square (广场), Dalian (大连)

Zhongshan Square was built by the Russians in 1898, who named it Nikolayevskaya Ploshad (Nikolai's Square). The Japanese called it "Ohiroba" (Large Plaza). Finally, the Chinese named it Zhongshan Square in 1945 after Sun Zhongshan (孫中山) (aka Sun Yat-sen 孫逸仙). Ten roads meet here.

Zhongshan is also the name of a city in Guangdong province

Macau is the Las Vegas of China

I was trying to avoid the obvious but I might as well say it.

Las Vegas has 1.9 million people in its metro area. "Las Vegas is an internationally renowned major resort city for gambling, shopping, and fine dining. The city bills itself as The Entertainment Capital of the World, and is famous for its consolidated casino–hotels and associated entertainment."

Macau is a former Portuguese colony with a population of 569,000. The economy is based on tourism and gambling and it has 5 times the gaming revenue of Las Vegas, with some of the same resorts (Venetian, Wynn). Neighboring Zhuhai has about 1.6 million. (Cars in Macau drive on the left and those in Zhuhai drive on the right).

Las Vegas has 1.9 million people in its metro area. "Las Vegas is an internationally renowned major resort city for gambling, shopping, and fine dining. The city bills itself as The Entertainment Capital of the World, and is famous for its consolidated casino–hotels and associated entertainment."

Macau is a former Portuguese colony with a population of 569,000. The economy is based on tourism and gambling and it has 5 times the gaming revenue of Las Vegas, with some of the same resorts (Venetian, Wynn). Neighboring Zhuhai has about 1.6 million. (Cars in Macau drive on the left and those in Zhuhai drive on the right).

Suzhou is the Pittsburgh of China

Night view of Pittsburgh

Pittsburgh has a population of 2.4 million, and is known colloquially as "the City of Bridges" and "the Steel City" for its many bridges and former steel manufacturing base. "Pittsburgh still maintains its status as a corporate headquarters city, with eight Fortune 500 companies calling the city home." Pittsburgh is located where the the Allegheny and Monongahela rivers meet to form the Ohio River. It is called the "Paris of Appalachia".

Night view of Suzhou

Suzhou (苏州) has a population of 4.1 million in its urban area. "The city is situated on the lower reaches of the Yangtze River and on the shores of Taihu Lake. The city's canals, stone bridges, pagodas, and meticulously designed gardens have contributed to its status as one of the top tourist attractions in China." It is developing Suzhou Industrial Park (jointly with Singapore) and the Suzhou Hi-Tech Industrial Development Zone. It is the second-largest industrial city in China. The "Gate of the Orient" is a 74-story building that will be the iconic symbol of Suzhou, but some say that it resembles a pair of pants. Suzhou is called the "Venice of the East".

Jersey City

Skyline of Jersey City

Northern New Jersey gets no respect. It is always lumped in with New York City. Its largest city, Newark, has only 278,000 residence. But its 10 most-populated northern counties together have a population of about 6 million in an area of about 2500 sq. miles, with a GDP of about $339 billion/year. On a map this is roughly the area east of I-287. This makes Northern New Jersey the 16th most economically powerful city on earth, and 8th in the US, ahead of Boston and San Francisco. Jersey City has 6 skyscrapers taller than 150m, with another one, Harborside Plaza 7, planned. It has the 98th best skyline on the planet, beating out Pittsburgh and Detroit.

New York is still ranked #2 (after Tokyo) even without New Jersey. So welcome Jersey City/Northern New Jersey! It would never show up on the list of best cities on earth elsewhere by the European snobs. But let's hear it for New Jersey.

New York

The New York Megapolitan Area should also be split up for comparison purposes. I now show it as 1.28 tn gdp. (Source). Here are the parts:

- New York City and Long Island. NYC itself has 8.2 million. Nassau County has 1.3 million, and Suffolk County has 1.5 million, Westchester County has 949,000, and Rockland County has 312,000 for a total of 12.3 million. For census purposes, this is the New York-White Plains-Wayne, NY-NJ Division + the Nassau-Suffolk Division - 3 counties in NJ (Bergen, Hudson, Passaic). The gross NY state product is $1.16 trillion, and the population of the whole state is 19.5 million. The estimated GDP of NYC itself (the areas listed above) is $850 bn.

- Northern New Jersey. Bergen, Essex, Hudson, Mercer, Middlesex, Monmouth, Morris, Passaic, Somerset and Union counties. Total population 6 million. This is the Edison-New Brunswick, NJ area + Newark-Union, NJ area plus the three counties above less a couple of small counties. The gross NJ state product is $497 bn and the population is 8.8 million. So a reasonable estimate would be $339 bn.

- The Connecticut parts are in the Bridgeport-Stamford-Norwalk MSA. This has 889,000 residents and a GDP of $85 billion.

Hangzhou is the Seattle of China

Downtown Seattle

Seattle was named after Chief Si'ahl of the local Duwamish and Suquamish tribes. It is is situated on a narrow isthmus between Puget Sound (an arm of the Pacific Ocean) and Lake Washington. The city is hilly, and many boats travel the bodies of water that surround it. The city developed as a technology center in the 1980s. "The stream of new software, biotechnology, and internet companies led to an economic revival, which increased the city's population by 50,000 between 1990 and 2000." More recently, Seattle has become a hub for "green" industry and a model for sustainable development. Seattle has a population of 3.5 million in its metropolitan area.

West Lake, Hangzhou

Hangzhou is the capital of Zhejiang Province, and has a population of 6.2 million people in its urban area. It has been one of the most renowned and prosperous cities of China for much of the last 1,000 years, due in part to its beautiful natural scenery. Marco Polo visited it about 1300 when it was the largest city in the world with a population of 1 million at that time. The city's West Lake is its best-known attraction. "The [Hangzhou] Hi-tech Zone makes good use of the concentrated superior intelligence in the park zone, relies on Hangzhou city's richly endowed natural environment and depends on preferential investment policies to gradually build a scientifically based hi-tech city --- Paradise Silicon Valley will capture world attention."

Update: Fireworks run amok in Hangzhou, 151 injured

Top Cities - October #2

I'm doing another list because of changes and updates. The number is nominal GDP in US$ (billions). For Chinese cities, I arbitrarily used an exchange rate of 5 yuan to 1 US$ because their currency is undervalued, so this has all the Chinese cities with a GDP of 500 billion yuan or more. I split up the megapolitan areas of Tokyo, Seoul and Los Angeles to make this more consistent. I'm continuing the practice of giving some of the cities their Chinese names so I can get familiar with the characters used. There are so few European cities here that I bold them to make them stand out. Chinese cities are in italics.

Dongguan [85]

Xi'an, Shaanxi [65]

Harbin, Heilongjiang [73]

Changchun, Jilin [67]

Kunming, Yunnan [42]

Taiyuan, Shanxi [36]

Changsha, Hunan [91]

Jinan, Shandong [67]

Xiamen, Fujian [41]

Changzhou, Jiangsu [61]

Hefei, Anhui [54]

Xuzhou, Jiangsu [59]

Fuzhou, Fujian [62]

Tangshan, Hebei [89]

Nanchang, Jiangxi [44]

Kaohsiung, Taiwan [58]

- Tokyo (1) [東京] [923]

- New York (2) [纽约] [850]

- Paris (7) [巴黎] [764]

- London (3) [伦敦] [752]

- Los Angeles (8) [洛杉矶] [556]

- Chicago(10) [芝加哥] [532]

- Sao Paulo (5) [圣保罗] [472]

- Washington DC (ex. Baltimore) (15) [华盛顿] [425]

- Osaka (19) [大阪] [389]

- Houston (14) [休斯顿] [385]

- Dallas/Ft. Worth (12) [达拉斯] [374]

- Nagoya (58) [名古屋] [372]

- Philadelphia (17) [费城] [347]

- Shanghai (6) [上海] [343]

- Seoul (4) [首尔] [343]

- Northern New Jersey (New York) (-) [339]

- Guangzhou/Foshan (20) [广州] [328]

- Yokohama (Tokyo) (-) [横滨] [320]

- Boston (24) [波士顿] [314]

- Sydney (41) [悉尼] [308]

- San Francisco/Oakland (26) [旧金山] [296]

- Toronto (44) [多伦多] [292]

- Gyeonggi (Seoul) (-) [京畿道] [289]

- Beijing (11) [北京] [282]

- Melbourne (45) [墨尔本] [275]

- Atlanta (23) [亚特兰大] [272]

- Mexico City (18) [墨西哥城] [262]

- Singapore [新加坡] [260]

- Miami (21) [迈阿密][258]

- Hong Kong (13) [香港] [243]

- Seattle (50) [西雅图] [231]

- Moscow (9) [225]

- Abu Dhabi (-) [219] AED 806 bn

- Saitama (Tokyo) (-) [211]

- Ruhr (68) [203]

- Buenos Aires (22) [202]

- Rio de Janeiro (32) [201]

- Minneapolis (54) [200]

- Montreal (59) [199]

- Detroit (36) [198]

- Chiba (Tokyo) (-) [197]

- Phoenix (42) [191]

- Shenzhen, Guangdong (16) [深圳] [191]

- Tianjin (29) [天津] [185]

- Fukuoka (-) [185]

- Frankfurt (-) [185]

- Suzhou, Jiangsu (51) [苏州] [185]

- Orange County (Los Angeles) (62) [180]

- Taipei, Taiwan (27) [台北市] [178]

- Kuwait City (84) [177]

- Milan (-) [177]

- San Diego (57) [172]

- Madrid (48) [169]

- San Jose (-) [168]

- Chongqing (31) [重庆] [159]

- Denver (ex. Boulder) (85) [158]

- Riyadh (77) [154]

- Munich-Augsburg (-)[149]

- Doha, Qatar (79) [145]

- Baltimore (82) [145]

- Berlin (72) [142]

- Istanbul (39) [141]

- Brisbane [138]

- Oslo [136]

- Brussels [131]

- Rome [130]

- Barcelona [130]

- St. Louis, MO [130]

- Portland, OR [125]

- Lisbon [122]

- Vancouver, Canada [121]

- Stockholm [120]

- Hiroshima [120]

- Hangzhou, Zhejiang [杭州] [119]

- Perth [117]

- Pittsburgh [116]

- Copenhagen [116]

- Wuxi, Jiangsu [无锡] [116]

- Tampa/St. Petersburg, FL (ex. Sarasota) [114]

- Charlotte [114]

- Hamburg [114]

- Qingdao, Shangdong [青岛] [113]

- Wuhan, Hubei [武汉] [111]

- Chengdu, Sichuan [成都] [111]

- Santiago [110]

- Brasilia [110]

- Riverside-San Bernadino (Los Angeles) [110]

- Kansas City [106]

- Cleveland, OH [106]

- Indianapolis [105]

- Dusseldorf [105]

- Orlando [104]

- Ningbo, Zhejiang (78) [宁波] [103]

- Dubai/Sharjah [103]

- Birmingham, UK [103]

- Dalian, Liaoning [大连] [103]

- Nanjing, Jiangsu [南京] [102]

- Monterrey [102]

- Vienna [102]

- Cincinnati, OH [101]

- Kyoto (Osaka) [101]

- Shenyang, Liaoning [沈阳] [100]

- Mumbai [100]

Dongguan [85]

Xi'an, Shaanxi [65]

Harbin, Heilongjiang [73]

Changchun, Jilin [67]

Kunming, Yunnan [42]

Taiyuan, Shanxi [36]

Changsha, Hunan [91]

Jinan, Shandong [67]

Xiamen, Fujian [41]

Changzhou, Jiangsu [61]

Hefei, Anhui [54]

Xuzhou, Jiangsu [59]

Fuzhou, Fujian [62]

Tangshan, Hebei [89]

Nanchang, Jiangxi [44]

Kaohsiung, Taiwan [58]

Saturday, October 13, 2012

Halloween Stock Market Crash

The stock market is likely to crash (drop 20%) about Halloween, right before the election, based on fears of the "fiscal cliff". It is more likely that Romney can get an agreement on the fiscal cliff than Obama can, so voters may be scared into voting for Romney.

So there are 4 predictions:

1. Stock market crash on Halloween, plus or minus 3 days.

2. Romney will win the election

3. Riots break out in protest

4. Agreement on fiscal cliff before Dec. 21.

Let's see if these happen. Exciting times are ahead.

See: http://www.zerohedge.com/news/2012-10-13/us-fiscal-moment-cliff-slope-or-wile-e-coyote

" Keep in mind that the stakes are much bigger this time. Last summer they had only the debt ceiling to deal with. This time there is the debt ceiling, the Alternative Minimum Tax ($120bn), tax extenders ($20bn), the Medicare doc fix ($20bn), the payroll tax cut ($120bn), extended unemployment benefits ($40bn), the sequester ($110bn), the Bush tax cuts ($180bn), Obama Care taxes ($20bn) and a number of other expiring programs ($90bn)."

So there are 4 predictions:

1. Stock market crash on Halloween, plus or minus 3 days.

2. Romney will win the election

3. Riots break out in protest

4. Agreement on fiscal cliff before Dec. 21.

Let's see if these happen. Exciting times are ahead.

See: http://www.zerohedge.com/news/2012-10-13/us-fiscal-moment-cliff-slope-or-wile-e-coyote

" Keep in mind that the stakes are much bigger this time. Last summer they had only the debt ceiling to deal with. This time there is the debt ceiling, the Alternative Minimum Tax ($120bn), tax extenders ($20bn), the Medicare doc fix ($20bn), the payroll tax cut ($120bn), extended unemployment benefits ($40bn), the sequester ($110bn), the Bush tax cuts ($180bn), Obama Care taxes ($20bn) and a number of other expiring programs ($90bn)."

Who is Zhang Yue?

Zhang Yue. "Chairman Zhang"

The man who will build the tallest building on earth in only 7 months. He builds skyscrapers in factories, like other people build ships. His company is called Broad Air Conditioning, but it does far more than heating and cooling. Watch out Chuck Norris, you have a competitor. And he is a cult leader and an environmentalist. Call him Chairman Zhang. Here are some of his sayings:

- "After reaching a certain level of material wealth ... people should focus on their quality of life. Quality of life includes many elements, most of which are irrelevant to money."

- "plant trees and do not rely on consumption and travel to fill empty spaces in life"

- "Use natural ventilation or a fan instead of air conditioning"

- "save people from destroying themselves"

- We must bring cities together and stretch for the sky in order to save cities and save the Earth. We must eliminate most traffic, traffic that has no value! And we must reduce our dependency on roads and transportation."

Sky City, a 220-floor skyscraper, soon to be built in China.

Sky City, a 220-floor skyscraper, soon to be built in China.============

See also:

Chinese to serve Super Tall buildings like McDonald's

===========Once Chairman Zhang is finished with Sky City, he plans on building a 636-story, 2 kilometer high tower.

Randstad

I previously had a city listed as Randstad, which covered most of the Netherlands. It should instead be split out as follows. I can't find any source for GDP so I am basing this on $50,000/person.

Amsterdam. 1,440,000. GDP $72 bn. Another source says 35 bn euros, so this is reasonable.

Rotterdam. 1,190,000. GDP $60 bn.

The Hague . 978,000. GDP $49 bn.

Utrecht. 564,000. GDP $28 bn.

The total is $209 bn, much less than my previous figure of $352 for the region, but I am also using smaller population figures.

Amsterdam. 1,440,000. GDP $72 bn. Another source says 35 bn euros, so this is reasonable.

Rotterdam. 1,190,000. GDP $60 bn.

The Hague . 978,000. GDP $49 bn.

Utrecht. 564,000. GDP $28 bn.

The total is $209 bn, much less than my previous figure of $352 for the region, but I am also using smaller population figures.

Milan

Milan is one of the cities that it is very hard to get numbers for. So this is an attempt to clarify the situation. Milan has 3.1 million people in its Larger Urban Zone. The nominal GDP of Milan is 136 bn euros, or about $177 billion. This is higher than the national average of about $32,500/person.

While I am at it, Rome has a population of 3.5 million in its LUZ, and an estimated GDP of 100 bn, or about $130 billion.

While I am at it, Rome has a population of 3.5 million in its LUZ, and an estimated GDP of 100 bn, or about $130 billion.

Seoul

Seoul has about 25 million people. (The Chinese name of the Seoul-Incheon metropolitan area is 汉城). But since I am splitting up the other major cities, I will split this as well.

These are the cities of note in South Korea

These are the cities of note in South Korea

- Gyeonggi Province (11.9 million, $289 billion)

- Seoul (首尔) (9.8 million, $343 billion)

- Busan (3.6 million, $76 billion)

- Incheon (2.7 million, $71 billion)

- Daegu (2.45 million, $45 billion)

Tokyo

I keep putting Tokyo at the top of every list because it has 35 million people in its metropolitan area with an annual GDP of $1.479 trillion. However, my research into China has convinced me that a tighter definition of "city" should be used when making comparisons. Suzhou has its own identity separate from Shanghai. And I now see Los Angeles as 3 cities: Los Angeles County, Orange County and Riverside/San Bernadino. In the US, I use Metropolitan Statistical Area (MSA) as the definition (not CSA), and in Europe the Larger Urban Zone (LUZ).

It's time to apply the same tighter definition to Japan. Each prefecture making up Tokyo should be treated as its own metro area. And the other big cities (Osaka, Nagoya) should be treated similarly.

So the list of cities in Japan will be as follows. (This is not a complete list of cities in Japan, just the most important ones). These are all prefectures, except for Kobe and Sapporo.

It's time to apply the same tighter definition to Japan. Each prefecture making up Tokyo should be treated as its own metro area. And the other big cities (Osaka, Nagoya) should be treated similarly.

So the list of cities in Japan will be as follows. (This is not a complete list of cities in Japan, just the most important ones). These are all prefectures, except for Kobe and Sapporo.

- Tokyo Metropolis (13.0 million, $923 billion)

- Yokohama/Kawasaki (Kanagawa prefecture), formerly included with Tokyo (9.0 million, $320 billion)

- Osaka (Osaka prefecture) (8.9 million, $389 billion)

- Nagoya (Aichi prefecture) (7.4 million, $372 billion)

- Saitama Prefecture, formerly included with Tokyo (7.2 million, $211 billion)

- Chiba Prefecture, formerly included with Tokyo (6.2 million, $197 billion)

- Fukuoka Prefecture (5.1 million, $185 billion)

- Hiroshima Prefecture (2.9 million, $120 billion)

- Kyoto Prefecture (2.6 million, $101 billion)

- Kobe (aka Kobe Metropolitan Employment Area, part of Hyogo prefecture) (2.3 million, est. $90 billion)

- Sapporo (Ishikari subprefecture) (2.3 million, est. $90 billion)

- Sendai (Miyagi prefecture) (2.3 million, $83 billion)

Supertall Ranking of Cities

These are all the cities in the world with at least 2 supertalls (300m/1000 ft).

- Dubai 18

- Hong Kong 6

- Chicago 6

- Guangzhou 5

- New York 5

- Abu Dhabi 4

- Shenzhen 4

- Shanghai 3

- Kuala Lumpur 3

- Kuwait 2

- Houston 2

- Nanjing 2

- Wuxi 2

Friday, October 12, 2012

Total Monetary Supply on June 30 and Sept 30

June 30, 2012 Monetary Supply. Revised to use Debt Held by the Public, called "Public Debt", instead of total National Debt.

M2 (as of 2012-06-25): 9933.6

Public Debt (as of 6/29/2012): 11044.2

Less Debt owned by Fed (as of 6/28/12): 1666.8

-----------------

Total Monetary Supply as of (6/30/2012): 19311.0

So the monetary inflation for the 2nd quarter was 1.6% which is not a problem.

========================================

Sept. 30 2012 Monetary Supply:

M2 (as of 9/24/12): 10123.0

Public Debt (as of 9/28/12): 11269.6

Less Owned by Fed (as of 9/27/12): 1643.2

----------------------------

Total Monetary Supply (as of 9/30/2012): 19749.4

The increase for the 3rd quarter was 2.27%, which is a problem. But the month of September itself showed only a tiny increase. So 9/30/12 would be a good starting point for measuring this because it is also the end of the fiscal year, and before QE3 got started. (There was some small amount of QE3 in September, about $23 billion, but nothing like what is coming).

=================

Update: Another key metric is the price of gold, which was $1771 as of the 9/28/12 close.

=================

Update: I am now calling this M4. The numbers as of 8/31/12 were:

M2 (as of 8/27/12): 10056.0

Public Debt (as of 8/31/12): 11273.6

Less Owned by Fed (as of 8/30/12): 1639.4

----------------------------

Total Monetary Supply (as of 9/30/2012): 19690.2

So the increase in September was 59.2 or 0.30%, as low as you could hope for.

M2 (as of 2012-06-25): 9933.6

Public Debt (as of 6/29/2012): 11044.2

Less Debt owned by Fed (as of 6/28/12): 1666.8

-----------------

Total Monetary Supply as of (6/30/2012): 19311.0

So the monetary inflation for the 2nd quarter was 1.6% which is not a problem.

========================================

Sept. 30 2012 Monetary Supply:

M2 (as of 9/24/12): 10123.0

Public Debt (as of 9/28/12): 11269.6

Less Owned by Fed (as of 9/27/12): 1643.2

----------------------------

Total Monetary Supply (as of 9/30/2012): 19749.4

The increase for the 3rd quarter was 2.27%, which is a problem. But the month of September itself showed only a tiny increase. So 9/30/12 would be a good starting point for measuring this because it is also the end of the fiscal year, and before QE3 got started. (There was some small amount of QE3 in September, about $23 billion, but nothing like what is coming).

=================

Update: Another key metric is the price of gold, which was $1771 as of the 9/28/12 close.

=================

Update: I am now calling this M4. The numbers as of 8/31/12 were:

M2 (as of 8/27/12): 10056.0

Public Debt (as of 8/31/12): 11273.6

Less Owned by Fed (as of 8/30/12): 1639.4

----------------------------

Total Monetary Supply (as of 9/30/2012): 19690.2

So the increase in September was 59.2 or 0.30%, as low as you could hope for.

Total Monetary Supply on May 1

I've noticed a change for the better in the economic situation starting about May 1. I'm using a new metric, which I call "total monetary supply", which is M2 + the National Debt, less Treasury securities owned by the Fed. I think that US Treasury bonds are really a form of money and should be treated as such. I'm concerned about monetary inflation and what QE3 will do. As I've stated before, I don't think the Fed buying up Treasury bonds is inflationary, but buying up Mortgage-Backed-Securities (MBS) is.

So everything before May 1 that we can write off to recovery from the great recession. But I do want to keep track of what happens after that date. To be consistent, this measurement should be done only once per month, using the last date in that month.

Here are the numbers from April 30, 2012:

M2 (2012-04-30) 9883.1

Nat. Debt (4/30/2012) 15692.4 [10916.0]

Less: Nat. Debt owned by Fed ( 4/26/2012) 1667.0

-----------------

Total Monetary Supply as of 4/30/2012: 23908.5 [19132.1]

===============

I don't necessarily want to calculate this each month, but it makes sense on a quarterly basis, so I can say, total monetary supply went up x% in the quarter. So lets jump back to March 30, 2012 as a baseline.

M2 (2012-03-26) 9827.1

Nat. Debt (3/31/2012) 15582.1 [10846.8]

Less: Nat. Debt owned by Fed (3/29/2012) 1667.9

-----------------

Total Monetary Supply as of 3/31/2012: 23741.3 [19006.0]

Watch this space. I fear that inflation will come roaring back, and it will take on a life of its own. I think up to 2% increase per quarter is probably fine, but any more is a cause for concern.

================

Update: I'm now thinking that this should not include intragovernmental liabilities such as Social Security. While this is a very real debt, it is owned by the Social Security Trust Fund and not by individuals. Since it can't be traded on the open market, it isn't equivalent to money. I have revised the above numbers to include the amount without intragovernmental liabilities in brackets.

So everything before May 1 that we can write off to recovery from the great recession. But I do want to keep track of what happens after that date. To be consistent, this measurement should be done only once per month, using the last date in that month.

Here are the numbers from April 30, 2012:

M2 (2012-04-30) 9883.1

Nat. Debt (4/30/2012) 15692.4 [10916.0]

Less: Nat. Debt owned by Fed ( 4/26/2012) 1667.0

-----------------

Total Monetary Supply as of 4/30/2012: 23908.5 [19132.1]

===============

I don't necessarily want to calculate this each month, but it makes sense on a quarterly basis, so I can say, total monetary supply went up x% in the quarter. So lets jump back to March 30, 2012 as a baseline.

M2 (2012-03-26) 9827.1

Nat. Debt (3/31/2012) 15582.1 [10846.8]

Less: Nat. Debt owned by Fed (3/29/2012) 1667.9

-----------------

Total Monetary Supply as of 3/31/2012: 23741.3 [19006.0]

Watch this space. I fear that inflation will come roaring back, and it will take on a life of its own. I think up to 2% increase per quarter is probably fine, but any more is a cause for concern.

================

Update: I'm now thinking that this should not include intragovernmental liabilities such as Social Security. While this is a very real debt, it is owned by the Social Security Trust Fund and not by individuals. Since it can't be traded on the open market, it isn't equivalent to money. I have revised the above numbers to include the amount without intragovernmental liabilities in brackets.

Top 20 Skyscrapers in 2016

These will be the tallest buildings in 2016. Completed buildings are bolded and under construction are in italics. Completion date in parenthesis.

Zifeng Tower, Nanjing, 450m (2010)

Willis Tower, Chicago, 442m,1974

Kingkey 100, Shenzhen, 442m, 2011

Guangzhou International Finance Center, 440m, 2010

Buildings that aren't expected to by completed by 2016, but may be completed soon after:

Suzhou Center Plaza, Suzhou, China, 780m (2017)

Wuhan Greenland Center; Wuhan, China, 636m (2017)

Rose Rock IFC in Tianjin, 588m (2017)

Evergrande IFC, Jinan, China, 560m (Unknown)

Doha Convention Centre and Tower; Doha, Qatar, 551m (construction suspended)

China Resources Headquarters; Shenzen, China, ; 525 m (2017)

Kaisa Feng Long Center; Shenzen, China, 518m (construction not started, 2015?)

See also Top 20 Skyscrapers in 2020

- Burj Khalifa, Dubai, 828m (2010)

- Ping An Finance Center, Shenzhen, 660m (2015)

Seoul Lite DMC, 640m (2015)(CANCELLED)- Shanghai Tower, 632m (2014) (Topped Out)

- Makkah Royal Clock Tower Hotel, Mecca, 601m (2012)

- Goldin Finance 117, Tianjin, 597m (2015)

- Lotte World Tower, Seoul, 555m (2015)

- One WTC, New York, 541m (2013)

- Tianjin CTF Binhai Center, 530m (2015)

- CTF Guangzhou, 530m (2016)

- Zhongguo Zun, Beijing, 528m (2016)

- Dalian Greenland Center, 518m (2016)

- Busan Lotte Town Tower, 510m (2016)

- Taipei 101, 509m (2004)

Federation Tower, 506m, Moscow (2016) (height 360m)- Shanghai World Financial Center, 492m (2008)

- International Commerce Centre, Hong Kong, 484m (2010)

- Tianjin RF Guandong Tower, 468m (2015)

- International Commerce Center 1, Chongqing, 468m (2016)

- Petronas Towers, Kuala Lumpur 452m (1998)

Zifeng Tower, Nanjing, 450m (2010)

Willis Tower, Chicago, 442m,1974

Kingkey 100, Shenzhen, 442m, 2011

Guangzhou International Finance Center, 440m, 2010

Buildings that aren't expected to by completed by 2016, but may be completed soon after:

Suzhou Center Plaza, Suzhou, China, 780m (2017)

Wuhan Greenland Center; Wuhan, China, 636m (2017)

Rose Rock IFC in Tianjin, 588m (2017)

Evergrande IFC, Jinan, China, 560m (Unknown)

Doha Convention Centre and Tower; Doha, Qatar, 551m (construction suspended)

China Resources Headquarters; Shenzen, China, ; 525 m (2017)

See also Top 20 Skyscrapers in 2020

Thursday, October 11, 2012

Cities of Opportunity

And yet another list ranking the world's top cities. These are the 27 cities at the center of the world economy. The number in parentheses is from my previous list, for comparison.

Cities that I put in the top 25 that are missing here are:

Dallas

Houston

Washington

Shenzhen

Philadelphia

Osaka

Guangzhou

Miami

Atlanta

Boston

Like many of these lists, I think this suffers from an anti-US and anti-Chinese bias. "Houston has been dropped from this year’s report in order to more evenly balance the US with the rest of the world." Yep, got to be politically correct when ranking the top cities.

- New York (2)

- London (3)

- Toronto (44)

- Paris (7)

- Stockholm (-)

- San Francisco (26)

- Singapore (33)

- Hong Kong (13)

- Chicago (10)

- Tokyo (1)

- Sydney (41)

- Berlin (72)

- Los Angeles (8)

- Seoul (4)

- Madrid (48)

- Milan (-)

- Beijing (11)

- Kuala Lumpur (63)

- Shanghai (6)

- Moscow (9)

- Mexico City (18)

- Abu Dhabi (-)

- Buenos Aires (22)

- Istanbul (39)

- Johannesburg (-)

- Sao Paulo (5)

- Mumbai (25)

Cities that I put in the top 25 that are missing here are:

Dallas

Houston

Washington

Shenzhen

Philadelphia

Osaka

Guangzhou

Miami

Atlanta

Boston

Like many of these lists, I think this suffers from an anti-US and anti-Chinese bias. "Houston has been dropped from this year’s report in order to more evenly balance the US with the rest of the world." Yep, got to be politically correct when ranking the top cities.

Top 10 Skyscaper cities in China

A skyscraper is a building taller than 150m (492 ft) .

#10. Chengdu (成都) 9

#9. Wuhan (武汉) 13

#8. Tianjin (天津) 17

#7. Chongqing (重庆) 21

#6. Beijing (北京) 22

#5. Nanjing (南京) 25

#4. Shenzhen (深圳) 58

#3. Guangzhou (广州) 63

#2. Hong Kong (香港) 68

#1. Shanghai (上海) 102

Source:http://www.china.org.cn/top10/2012-09/25/content_26621475_10.htm

=============

By comparison, here are the number of skyscrapers in US cities:

1. New York (纽约) 235

2. Chicago (芝加哥) 113

3. Houston ([休斯顿) 31

4. Miami (迈阿密) 30

5. Los Angeles (洛杉矶) 25

6. San Francisco (旧金山) 21

7. Dallas (达拉斯) 18

8. Boston (波士顿) 18

9. Atlanta (亚特兰大) 15

10. Philadelphia (费城) 15

Honorable mention:

Las Vegas 15

Seattle 13

Minneapolis 11

Pittsburgh 10

Detroit 8

Denver 7

#10. Chengdu (成都) 9

#9. Wuhan (武汉) 13

#8. Tianjin (天津) 17

#7. Chongqing (重庆) 21

#6. Beijing (北京) 22

#5. Nanjing (南京) 25

#4. Shenzhen (深圳) 58

#3. Guangzhou (广州) 63

#2. Hong Kong (香港) 68

#1. Shanghai (上海) 102

Source:http://www.china.org.cn/top10/2012-09/25/content_26621475_10.htm

=============

By comparison, here are the number of skyscrapers in US cities:

1. New York (纽约) 235

2. Chicago (芝加哥) 113

3. Houston ([休斯顿) 31

4. Miami (迈阿密) 30

5. Los Angeles (洛杉矶) 25

6. San Francisco (旧金山) 21

7. Dallas (达拉斯) 18

8. Boston (波士顿) 18

9. Atlanta (亚特兰大) 15

10. Philadelphia (费城) 15

Honorable mention:

Las Vegas 15

Seattle 13

Minneapolis 11

Pittsburgh 10

Detroit 8

Denver 7

D minus 70

Disaster still looms.

"The U.S. is heading towards fiscal disaster and no one in Washington is doing anything about it. Investors are putting too much faith in Congress and the White House to work out a deal, making the stock market a risky proposition. They really believe honestly that no Congress could be this stupid, and by God, they can."

--http://www.cnbc.com/id/49375694/

But read this: "By jumping off that fiscal cliff—more of a mogul, actually—the US would see the trajectory of its debt flatten out similarly. The deficit might drop to 1.2% of GDP by 2021, according to CBO estimates. Still miles away from a balanced budget, a total non-starter in our free-lunch QE culture. The mountain of debt would be much higher still. But it would be a start. On the other hand, if the fiscal cliff is not allowed to work its magic, the exponential growth of debt will simply continue to its bitter end."

--http://www.testosteronepit.com/home/2012/10/11/fear-mongering-and-hysteria-about-the-fiscal-cliff.html

So pick your poison. Disaster now, or annihilation later. I'm kind of rooting for the "fiscal cliff" to avoid worse problem in the future.

"The U.S. is heading towards fiscal disaster and no one in Washington is doing anything about it. Investors are putting too much faith in Congress and the White House to work out a deal, making the stock market a risky proposition. They really believe honestly that no Congress could be this stupid, and by God, they can."

--http://www.cnbc.com/id/49375694/

But read this: "By jumping off that fiscal cliff—more of a mogul, actually—the US would see the trajectory of its debt flatten out similarly. The deficit might drop to 1.2% of GDP by 2021, according to CBO estimates. Still miles away from a balanced budget, a total non-starter in our free-lunch QE culture. The mountain of debt would be much higher still. But it would be a start. On the other hand, if the fiscal cliff is not allowed to work its magic, the exponential growth of debt will simply continue to its bitter end."

--http://www.testosteronepit.com/home/2012/10/11/fear-mongering-and-hysteria-about-the-fiscal-cliff.html

So pick your poison. Disaster now, or annihilation later. I'm kind of rooting for the "fiscal cliff" to avoid worse problem in the future.

Practicing Shariah Law

"Practicing Law in Shariah Courts: Seven Strategies for Achieving Justice in Shariah Courts

describes the Shariah courts of Northern Nigeria, and offers advice for

counsel practicing in Shariah courts worldwide, particularly in cases

involving women.

In this important book, you'll find insight into practicing law in Shariah courts, and some questions that arise from being on the field, from the authors experience of seeking justice under these laws both legally and spiritually.

The introduction of new Shariah in Northern Nigeria in 1999 set in place a delicate and flexible boundary between the rule of law and individual interpretations of the Law that are unjustifiably causing individual and social ills. This important book is part of a dialogue for learning the terrain and how best to work around the disparities in the new Shariah, exploring ethical issues drawn from various sources, including the Holy Qur'an, Hadith, and Sunnah. Although their application is discussed within the legal contour of Shariah law in Northern Nigeria, the strategies are not confined to any one framework of reference and may be a valued resource to many.

The book contains the author's reflection of her experiences while defending clients in Shariah courts. It is a book written by a legal practitioner, sharing the strategies and resources that have served her well throughout her career. The multilayered composition of this book, weaving together Islamic law, national laws, international treatises, and religious texts is intent on providing lawyers all possible avenues for drafting a defense strategy that reflects the integrity of Shariah and upholds the values of the community.

Since their implementation and subsequent codification from 2000 to 2003, Shariah law codes have been regularly amended. This book reflects the latest of the amendments known to the author. The strategies and resources outlined in this book move past them and look toward the overarching ideal of justice and fairness, placing them in a space that sustains the functional character of the work."

--http://apps.americanbar.org/abastore/index.cfm?section=main&fm=Product.AddToCart&pid=1620515&sc_cid=1620515-13C

Shariah Law - coming soon to a courthouse near you.

In this important book, you'll find insight into practicing law in Shariah courts, and some questions that arise from being on the field, from the authors experience of seeking justice under these laws both legally and spiritually.

The introduction of new Shariah in Northern Nigeria in 1999 set in place a delicate and flexible boundary between the rule of law and individual interpretations of the Law that are unjustifiably causing individual and social ills. This important book is part of a dialogue for learning the terrain and how best to work around the disparities in the new Shariah, exploring ethical issues drawn from various sources, including the Holy Qur'an, Hadith, and Sunnah. Although their application is discussed within the legal contour of Shariah law in Northern Nigeria, the strategies are not confined to any one framework of reference and may be a valued resource to many.